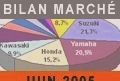

The motorcycle market in the first half of 2005

In a gloomy economic situation, motorcycles continue to attract: the two-wheeler market grew by + 4.6% in the first half! We are far from the invasion feared by the City of Paris, but the motorcycle shows that it has more than ever its place. Balance sheet.

In a rather gloomy economic situation, motorcycles continue to seduce the French: the two-wheeler market recorded growth of + 4.6% in the first half of the year.

We are still far from the invasion so dreaded by the City of Paris, desperately tightened on its small particular interests, but several years of steady growth show that the motorcycle has more than ever its place in the road landscape. Especially since it pollutes less (read).

More boring for the government, as it should be from Dominique de Galouzeau de Villepin, the 125 cc with the utilitarian and reasonable image of a good father are stagnating (-0.8%) while they are the very uncivil "big cubes" which progress (+ 8.3%)…

The registered quad market has undoubtedly reached maturity (-1.7%), with four major players (Kymco, Polaris, Linhai and SMC) now controlling 56% of the market.

125 cc: the status quo

In a market that grew slightly in June (+ 4.2%), Honda, firmly attached to the timeless Varadero 125, remains the leader even if its star scooter, the Pantheon, is starting to lose its footing in front of its competitors.

Similarly, Piaggio is losing ground (-7.2%): the X8 loses its leading position in favor of the Yamaha YP125 Majesty (read) and the X9 gives up its 4th place to the Suzuki UH125 Burgman. Supported by an aggressive trade policy, these two Japanese scooters are making very strong progress.

However, Yamaha is stagnant (-0.6%) because sales of XT 125 do not take off. And behind the three leaders with relatively stable positions, the outsiders are pushing very hard: Suzuki with its Burgman (+ 39%), MBK (+ 21.9%) and the revenant Aprilia (+ 39%), including the new Atlantic 125. sells very well.

Kymco continues its steady progression (+ 7.6%) while Peugeot sinks a little more (-21%)…

The same trends can be observed over the first six months of the year: the three leaders – Honda, Yamaha and Piaggio – lose some ground in favor of commercially aggressive pursuers: Suzuki, MBK, Aprilia, Kymco, Daelim…

As in the automotive market, customers do not hesitate to compete for better prices. But they still remain reluctant with regard to new Chinese productions with certainly exotic names, but still not very evocative: Sym, CF Moto, Jincheng, Zongshen … Sales therefore remain marginal, also for lack of an extensive network: we does not yet sell a scooter like an iron or cell phone !

The Peugeot case appears more problematic: the Elystar is a modern machine sold by an extended network, but its sales plunge (-23%) … Will the Jet Force really be able to reverse this trend? Response over the next few months … Derbi’s decline is even more surprising: are these pretty machines intended for "youngsters" still too expensive ?

On the off-road side, high prices do not scare customers if the quality is there, as demonstrated by KTM (+ 25.5%) and GasGas (+ 36%). As for Husqvarna, it maintains its positions (+ 2.3%).

Over 125: an exceptional but distorted month of June

Registrations of over 125 cc increased by … 19.9% in June, but this figure is partly skewed by the massive registration of 2-stroke off-road motorcycles. Because as the importer GasGas told Moto-Net, 2-stroke trial and enduro motorcycles benefited from an exemption to remain in Euro 1 until June 30. But they are now also subject to Euro2 standards, so importers have registered all their remaining stocks of Euro1 motorcycles! Thus the Yamaha WR250F finds itself 4th sale in June, behind the Fazer 600! Likewise GasGas, which only markets 2-stroke, registered a trifle of 931 motorcycles, as many as during the first five months of the year. !

Apart from this distortion, Yamaha is doing very well by placing six models in the 15 best sales of the month (+ 31%)! On the other hand, the MT-01, after the spectacular launch effect (read and), falls back to more standard levels for a niche motorcycle sold at this price (175 units in June).

The Suzuki GSF 650 Bandit took first place in sales, ahead of the Kawasaki Z750. The new Bandit 650 thus confirms the warm welcome it has received from the press (read) but the SV 650, probably a victim of the weight of the years, regularly loses ground. So much so that in the end, the manufacturer of Hammamatsu shows only an increase of + 5.2%.

Whether sports or roadsters, the new Honda are struggling to seduce the French, especially because of rather high prices. Sales of No. 1 are therefore affected with a drop of 8.1% while Kawasaki, still on the wave of the success of its Z750 (read and), maintains its positions at + 0.9%.

As in previous months, European and American manufacturers of character motorcycles made strong progress with the exception of Ducati (-17.7%). Finally, let’s hope that GasGas won’t hold it against us if we don’t go into ecstasies for too long on its June registrations, up … + 574.6%! (read above).

Over the first six months, we note the good progress of the off-road motorcycle specialists: Husqvarna, HM, Beta, Sherco, Scorpa are showing good progress. The fairly good success of the Beta Alp shows that there is, alongside competition machines, a place for a leisure trail really suited to off-road riding..

Small road bike craftsmen have more difficulties, because of the offensive of the "industrial" specialists in character bikes such as BMW, Triumph or Ducati. Aprilia (+ 9.5%) and Voxan (+ 8%) are making little progress, while Buell (-3.4%) and Moto Guzzi (-35%!) Are down. Not to mention the MV Agusta (72 motorcycles), Mondial (41 motorcycles), Cagiva (9 motorcycles) or other MZ (2 motorcycles!), Which we unfortunately see more in press parks than on the road…

Should we conclude that today even the dream is industrialized? For the benefit of the consumer, of course !

Benoît LACOSTE

Related articles

-

Market reports – First half of 2015: Suzuki’s market report – Used SUZUKI

First half of 2015: Suzuki’s market report Suzuki has just completed the first half of 2015 with a decrease of -7.1% and has a total of 5,837…

-

Market reports – May 2005 motorbike market: sham growth –

Motorcycle market May 2005: trompe l’oeil growth After an encouraging month in April, this month of May looks good, with growth of 4.7% for the 125s and…

-

Market reports – The motorcycle market on the rise –

The motorcycle market on the rise At the end of the first half of 2008, the French market for 125cc and over 125cc sets a new record with 129,181…

-

Market reports – Pierre-Laurent Feriti: Suzuki is second for the first time – Used SUZUKI

Pierre-Laurent Feriti: For the first time, Suzuki is second With 32,096 registrations in 2007, Suzuki posted a 2.9% increase in the French motorcycle…

-

Market reports – Motorcycle market September 2005: the Japanese in decline –

Motorcycle market September 2005: Japanese women in decline Radiant for the 125 market, which increased by 18%, the return to the school year was more…

-

Market reports – Motorcycle market: the holidays before their time! –

Motorcycle market: the holidays before their time ! The two-wheeler market has achieved an excellent end of the year with + 40% for the 125 and + 20% in…

-

First half of 2015: DIP’s market report DIP imports the brands of motorized two-wheelers Daelim, Royal Enfield, Keeway, Benelli and Orcal Motor into…

-

Market reports – First half of 2014: Piaggio’s market report – Second hand PIAGGIO

First half of 2014: Piaggio’s market report Piaggio has just completed the first half with a decrease of -13.3% with 3,674 registrations. Laurent…

-

Market reports – First half of 2013: Suzuki’s market report – Used SUZUKI

First half of 2013: Suzuki’s market report Suzuki has just completed the first half of 2013 with a decrease of -16.1% and has a total of 6,162…

-

Market reports – Global motorcycle market report –

Overall assessment of the motorcycle market The trends observed in the first half of the year are confirmed: the overall market is up 4.3% compared to…